Even If You’ve Been Denied Before…

Get The Business Credit & Financing You Need To Grow With

Business Credit Builder’s New Fundability System

Discover How the Fundability System Really Works To Get You Business Credit Approvals.

Access The New & Improved Fundability System™

The Fundability System is the first of its kind—the one and only Fundability™ and Financing software that exists on the market today.

Our new, interactive Fundability System™ adapts to each and every business owner and their unique situation, responding intuitively to the answers you provide, generating a step-by-step, personalized funding plan to quickly build your business credit, apply for financing, and get approved for hundreds of thousands in business credit and loans … all in one place.

Through Fundability™, we give business owners like you the opportunity to SUCCEED in building their dream, growing their business, and having a real chance at lasting success.

It’s a proven, simple, easy-to-use system that’s helped nearly 50,000 business owners get the funding and credit they need for their business.

Plus … It works even if you’ve been in business for years or you’re just getting started.

Here’s Exactly What You Get In

The Fundability System™

BUSINESS FUNDABILITY

- National & Local Business Listings

- EIN and Entity Setup Assistance

- Business Industry Fundability Check

- Business Address Fundability Check

- Business Phone Fundability Check

- Website & Email Fundability Check

- Bank & Merchant Account Setup Assistance

BUSINESS FUNDING SOLUTIONS

- Dispute Damaged Business Credit

- Business Credit Reports & Score Training

- Get Setup with D&B, Experian & Equifax

- Largest Curated Selection of Vendors

- Largest Selection of High-Limit Retail Credit

- Access High-Limit Fleet Credit

- Access High-Limit Business Credit Cards

- Access Auto Vehicle Financing with No PG

- Unsecured, No-Doc, 0% Financing

- Get Loans with Rates of 5% and Less

- Access Accounts With or Without a PG

- Prequalified Matched Accounts

FINANCE AND ADVISOR SUPPORT

- Full Mobile Access

- Get Business Bureau Insights & Scores Every 30 Days (additional purchase)

- Secure Business Loans within 72 Hours

- Finance Specialist Support

- Get Loans with Record-Low Rates

- Cash Flow Monitoring (coming Soon)

- LexisNexis Report

- ChexSystems Report

3 Things the Fundability System Does For Business Owners:

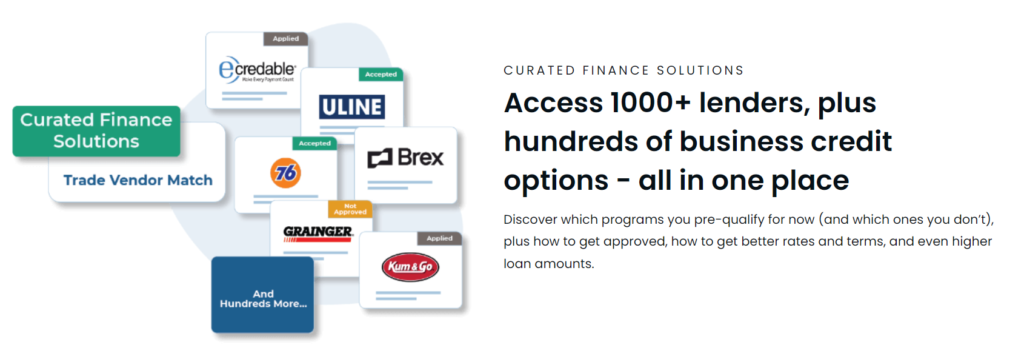

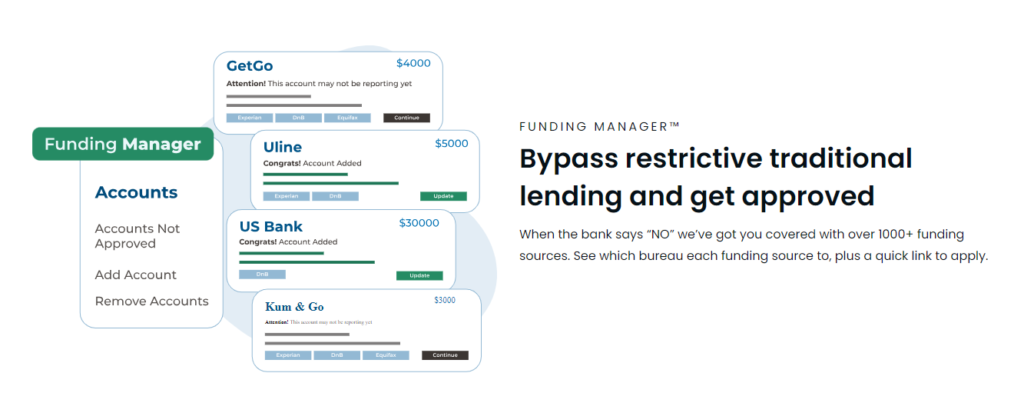

- Gives Your Business Access To Hundreds of Funding Sources. Fundability matches your business with every legitimate type of funding that is available today, all in one place and shows business owners exactly what they need to focus on to qualify.

2. Improves Overall Business Fundability For Optimal Funding. Discover which programs you pre-qualify for now (and which ones you don’t), plus how to get approved, how to get better rates and terms, even highter amounts.

3. Accelerates Real Business Credit Building. Helps your business clients quickly build real business credit to preserve personal credit, operate their business, and ensure the best rates, terms, and approval amountson all kinds of business funding.

Try The Fundability System For Yourself

Frequently asked questions

You can qualify for real usable vendor credit immediately. You’ll then start to qualify for store credit within 60-90 days that doesn’t require a personal credit check or personal guarantee. Within 6 months, you should have access to $50,000 in real usable credit, including Visa and MasterCard accounts. You can then continue to build $100,000-$250,000 or higher in business credit within a year to two. You can also gain access to cash funding programs within a couple of months or less.

Your credibility (or legitimacy) is fairly close to Fundability®, meaning that a business doesn’t appear to be ‘fly by night’. It’s about setting up your business the right way so that creditors and lenders WANT to loan you money. Fundability also encompasses the ability to pay back any extended credit or loans.

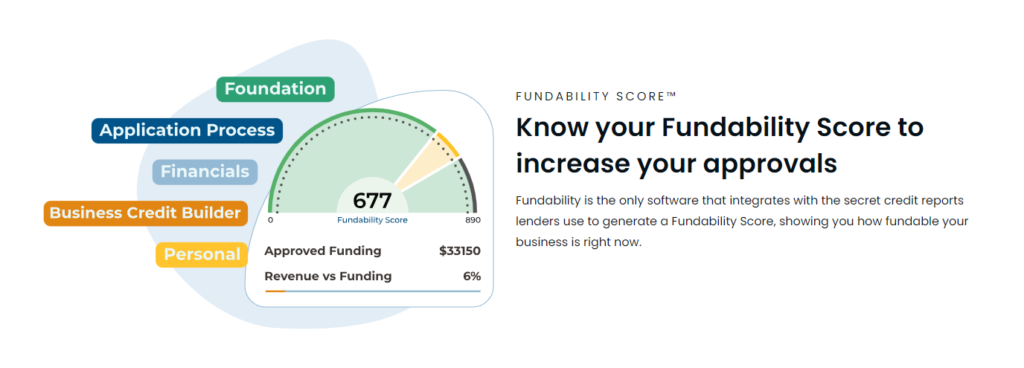

Your Fundability Score is a measure of how likely it is you’ll get approved for credit and funding right now.

Yes, any business can build business credit with Fundability®. Fundability® is a complex process, but we’ve made it super simple to ensure your success with building business credit. Fundability® is what gives you access to the loans and credit lines you need to grow your business in the shortest amount of time possible.

Fundability is for new and established businesses alike–large or small. Every business should have Fundability to ensure it can meet the demands that come with running a business: fast growth, slow seasons, changes in the economy, market fluctuations, unexpected emergencies and business opportunities that often arise at any given moment.

Absolutely! That’s what Fundability is designed to do–help any business get the money and credit they need to grow, even if you’ve been denied before.

Building business credit on your own can take years. Even when working with a specialist, it can take as long as 2-3 years. With Fundability, on average, it takes 6-9 months to build strong business credit. In only 12 months, your business can actually fund itself.

Fundability™ is a software that allows you to go at your own pace. How long it takes to get funding is partly dependent upon how fast you move through the system. Your ability to access cash is also dependent upon how fundable your business is right out of the gate, the type of loan you’re looking to qualify for and how much money you’re looking to get. On average, our customers are gaining access to cash funding programs within a couple of months or less.

Your credibility (or legitimacy) is fairly close to Fundability®, meaning that a business doesn’t appear to be ‘fly by night’. It’s about setting up your business the right way so that creditors and lenders WANT to loan you money. Fundability also encompasses the ability to pay back any extended credit or loans.

Your Fundability Score is a measure of how likely it is you’ll get approved for credit and funding right now.

Yes, any business can build business credit with Fundability®. Fundability® is a complex process, but we’ve made it super simple to ensure your success with building business credit. Fundability® is what gives you access to the loans and credit lines you need to grow your business in the shortest amount of time possible.

Fundability is for new and established businesses alike–large or small. Every business should have Fundability to ensure it can meet the demands that come with running a business: fast growth, slow seasons, changes in the economy, market fluctuations, unexpected emergencies and business opportunities that often arise at any given moment.

Absolutely! That’s what Fundability is designed to do–help any business get the money and credit they need to grow, even if you’ve been denied before.

Building business credit on your own can take years. Even when working with a specialist, it can take as long as 2-3 years. With Fundability, on average, it takes 6-9 months to build strong business credit. In only 12 months, your business can actually fund itself.

Fundability™ is a software that allows you to go at your own pace. How long it takes to get funding is partly dependent upon how fast you move through the system. Your ability to access cash is also dependent upon how fundable your business is right out of the gate, the type of loan you’re looking to qualify for and how much money you’re looking to get. On average, our customers are gaining access to cash funding programs within a couple of months or less.